Corporate Governance

- Basic stance

- Board of Directors

- Skill matrix

- Executive remuneration

- Evaluation of the Board of Directors’ effectiveness

- Advisory Committee

- Audit & Supervisory Board

- Other bodies and systems

- Cross-shareholding strategy

- Disclosures

Basic stance

Under the company creed, as an unchanging corporate stance, and the spirit of its management philosophy, which is based on changes in the social and business environment, the Daifuku Group will contribute to the development of society and the economy as a whole, continuously enhancing the effectiveness of corporate governance to achieve sustainable growth and increase corporate value over the medium to long term.

In accordance with this basic stance, we have established the Daifuku Group Basic Policy for Corporate Governance. In addition, the status of efforts for the Corporate Governance Code has been summarized. For details, please see the documents below:

Daifuku Group Basic Policy for Corporate Governance (750 KB)

Disclosure Based on the Principles of Japan’s Corporate Governance Code (836 KB)

The table below shows the main points required by the Corporate Governance Code and the Company’s response status.

| Main points required by the Corporate Governance Code |

Time | The Company’s response | |||

|---|---|---|---|---|---|

| Enhancing board independence | |||||

| Ensure that at least one-third of directors are independent outside directors | 2025 | 55% (6 out of 11) | |||

| Establish a nomination committee and remuneration committee (independent outside directors appointed as the majority of the committee) | Established a voluntary Advisory Committee (nomination/remuneration). The Committee comprising six (6) outside directors and one (1) representative director (For independence, please refer to the pages 26-27.) |

||||

| Disclose a skill matrix of board members conforming to the Company’s business strategy | Disclosed the skill matrix | ||||

| Appoint independent outside directors having managerial experiences at other companies | Appointed three (3) persons | ||||

| Ensuring diversity in the core human resources of the company | |||||

| Women | Number of female managers promoted | Year ended December 31, 2024 | 40 persons | ||

| Foreign nationals | Foreign nationality ratio of regular hires | 9.5% | |||

| Number of foreign managers | 6 persons | ||||

| Mid-career professionals | Career recruitment ratio | 44.8% | |||

| Career recruitment ratio for assistant managers | 41.3% | ||||

| Career recruitment ratio for managers | 31.4% | ||||

| Dealing with sustainability issues | |||||

| Enhance the quality and quantity of climate-related disclosure based on international frameworks | 2019 | Endorsed Task Force on Climate-Related Financial Disclosures (TCFD) recommendations | |||

| 2020 | Disclosed information on the impact of climate-related risks and opportunities on business activities, earnings, etc. | ||||

| 2023 | CO2 emissions reduction targets certified by the Science Based Targets initiative | ||||

| 2024 | Review of disclosures based on TCFD recommendations | ||||

| Develop a basic policy for the company's sustainability initiatives |

2021 | Announced Daifuku Environmental Vision 2050 (crucial issue areas and goals by 2030) |

|||

| Established Daifuku Group Human Rights Policy | |||||

| 2023 | Revised Daifuku Environmental Vision 2050 | ||||

| 2024 | Established Sustainable Procurement Guidelines | ||||

| Established Daifuku Group Sustainability Basic Policy | |||||

| Upwardly revised 2030 target for in-house CO2 emissions reduction targets (Scope 1 and 2) 50.4% reduction from FY2018 -> 60% reduction from FY2018 |

|||||

| Switched all electricity used at business sites in Japan to renewable energy sources |

|||||

| Main issues other than the above | |||||

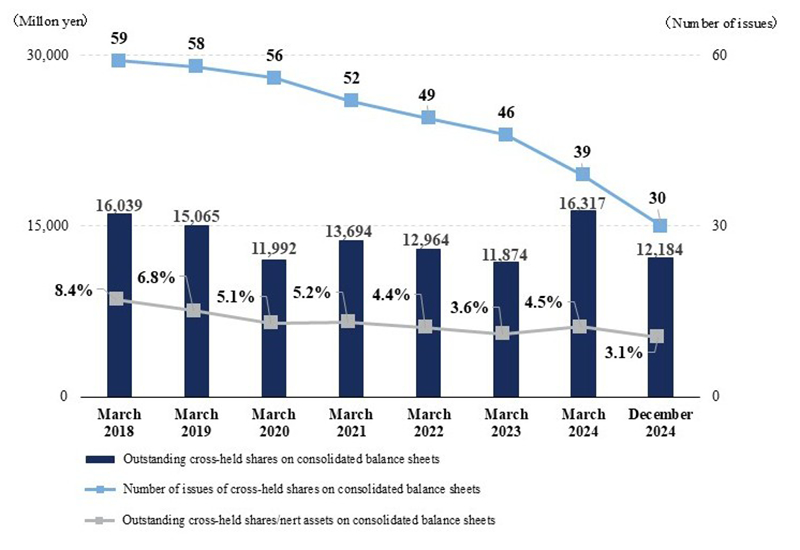

| Reduce cross-shareholdings | Number of issues (consolidated) | Amount recorded on consolidated balance sheets | Ratio to consolidated net assets | ||

| As of March 31, 2024 | 39 issues | 16.3 billion yen | 4.5% | ||

| As of December 31, 2024 | 30 issues | 12.1 billion yen | 3.1% | ||

| Promote the use of electronic voting platforms and disclose in English |

We use the electronic voting platform. We disclose most disclosure documents in English, including timely disclosures, financial announcements, financial presentations, convening notices, annual securities reports, corporate governance reports, and Daifuku Report as integrated reporting. |

||||

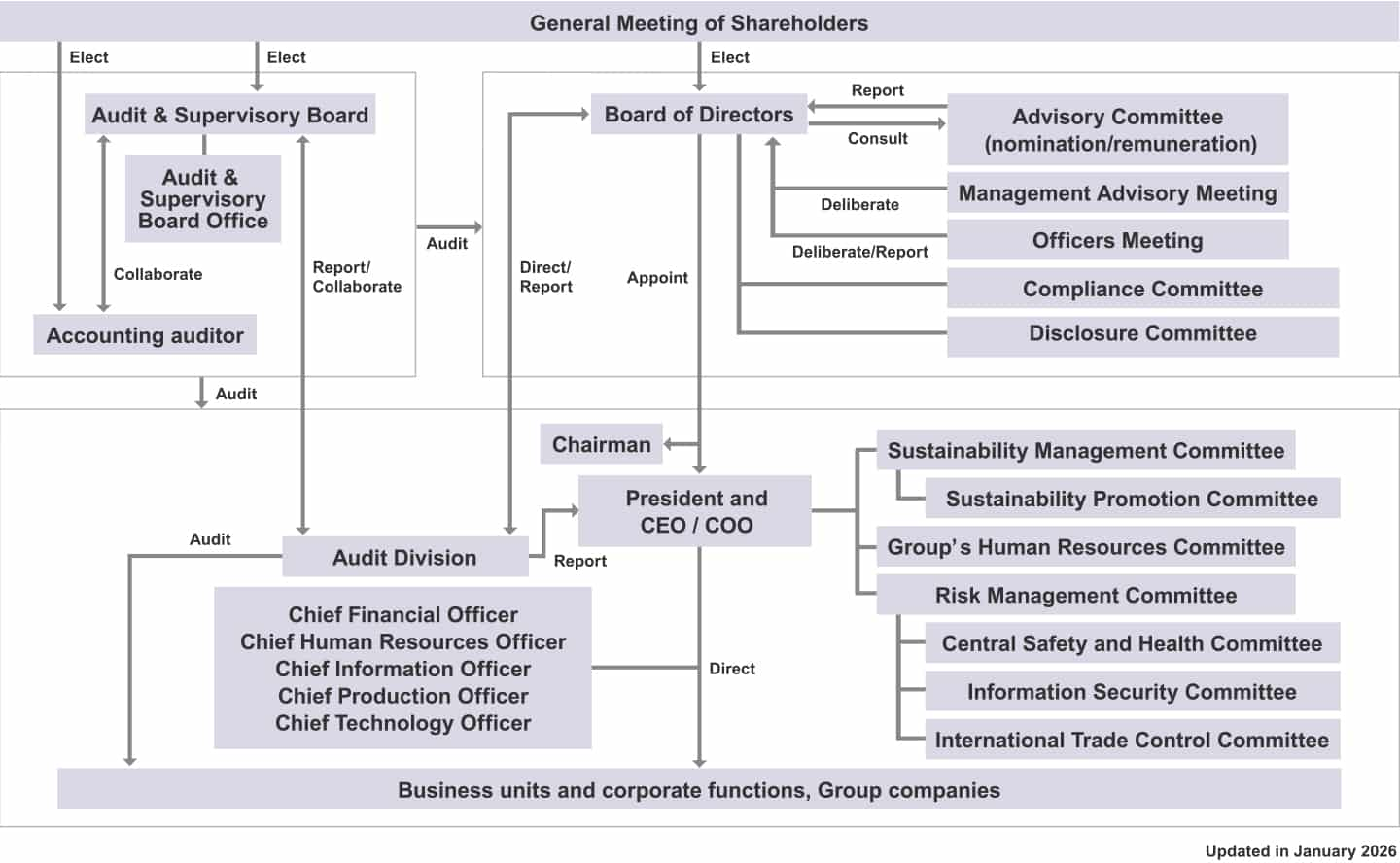

Corporate governance system

| Diversity in the Board of Directors (ratio) | |||

|---|---|---|---|

| March 2025 | Outside directors | Female directors | Foreign national directors |

| 55% (6 out of 11) | 18% (2 out of 11) | 9% (1 out of 11) | |

Reasons for adoption of the current corporate governance system

Daifuku Co., Ltd. is a company with an Audit & Supervisory Board. Under this basic structure, the Group has flexibly introduced and expanded systems to enhance management transparency and the management monitoring and supervision functions. We believe that the current corporate governance system is appropriate in terms of the workforce and business operations including scale of the Group and that we meet the expectations of shareholders, who entrust management to us.

Enhancement of the corporate governance system

| Our approach | |

|---|---|

| 2011 | Introduces a corporate officer system. |

| 2012 | An outside director elected. |

| 2014 | Two outside directors elected. |

| 2015 | Conducts evaluation of Board of Directors’ effectiveness for the first time. |

| 2016 |

|

| 2017 |

|

| 2018 |

|

| 2019 |

|

| 2020 | Establishes the Audit & Supervisory Board Office. |

| 2021 |

|

| 2022 | Delists Contec Co., Ltd. due to making it a wholly owned subsidiary. |

| 2023 |

|

| 2024 | A female Audit & Supervisory Board member (outside) elected. |

| 2025 |

|

Board of Directors

The Company’s Board of Directors makes decisions on matters related to important business execution, such as formulation of basic management policies and management strategies for sustainable growth of the Group and medium- to long-term enhancement of corporate value, in accordance with the agenda items to be discussed at meetings of the Board of Directors and matters to be reported to the Board of Directors as stipulated in the internal rules, and also performs management oversight functions. The Board of Directors’ management oversight functions have been strengthened by having several independent outside directors who have abundant experience and extensive knowledge and have no vested interest in the Company. Inside directors and outside directors engage in free and vigorous discussions, and the Board of Directors appropriately fulfills its role of making important decisions and overseeing business execution.

Main agenda items for Board of Directors meetings during the fiscal year ended December 31, 2024

- -Acquisition of treasury stock

- -Personnel changes concerning directors

- -Progress of the four-year business plan

- -Measures for growth strategies

- -Status of activities of the Advisory Committee, etc.

- -Reduction of cross-shareholdings

- -Promotion of sustainability management

- Number of meetings held in the fiscal year ended December 31, 2024

- 13 times (9 regular meetings and 4 extraordinary meetings)

Composition of the Board of Directors and attendance rate for the fiscal year ended December 31, 2024

| Title | Name | Attendance rate (times attended / times meetings held) |

|---|---|---|

| Representative Director President and CEO |

Hiroshi Geshiro (Chair) | 100% (13/13) |

| Director | Seiji Sato | |

| Hiroshi Nobuta | ||

| Hideaki Takubo | ||

| Toshiaki Hayashi | 100% (5/5) | |

| Tomoaki Terai | 100% (8/8) | |

| Outside Director | Yoshiaki Ozawa | 100% (13/13) |

| Mineo Sakai | ||

| Kaku Kato | ||

| Keiko Kaneko | ||

| Gideon Franklin | ||

| Audit & Supervisory Board Member (full-time) | Tsukasa Saito | |

| Audit & Supervisory Board Member (outside) | Ryosuke Aihara | 100% (5/5) |

| Tsukasa Miyajima | 92% (12/13) | |

| Nobuo Wada | 100% (13/13) | |

| Eiko Hakoda | 100% (8/8) |

Notes:

- Mr. Toshiaki Hayashi and Mr. Ryosuke Aihara resigned from the office of director and the office of Audit & Supervisory Board member at the conclusion of the Ordinary General Meeting of Shareholders held on June 21, 2024.

- Mr. Tomoaki Terai and Ms. Eiko Hakoda assumed the office of director and the office of Audit & Supervisory Board member, respectively, at the conclusion of the Ordinary General Meeting of Shareholders held on June 21, 2024.

Independence standards for outside directors and outside members of the Audit & Supervisory Board

At Daifuku, outside directors and outside members of the Audit & Supervisory Board are considered independent if they do not fall under any of Articles 1 to 5 below.

- Article 1

- A person who falls or fell under any of the following in the last three years:

- A person who executes business of a company, etc., that is a key customer of Daifuku or whose key business partner is Daifuku*1

- A lawyer who belongs to a law firm that has concluded an advisory contract with Daifuku or its subsidiary and who was actually in charge of legal business for Daifuku, a certified public accountant (or a certified tax accountant) who was an accounting auditor or accounting adviser of Daifuku or its subsidiary, or an employee, partner, or staff member who belongs to an auditing firm (or tax accountant corporation) that is an accounting auditor or accounting adviser of Daifuku or its subsidiary and who was actually in charge of the auditing service for Daifuku

- A lawyer, certified public accountant, or certified tax accountant, if not applicable to the above item 2, who provides specialized services, etc., to Daifuku by receiving a large amount*2 of money or assets other than remuneration for an officer, directly from the company

- An officer or employee of a company, etc., that is a major shareholder*3 of Daifuku

- Article 2

- An officer or employee of Daifuku’s subsidiary or a person who held such a position during the 10 years before being appointed as such status

- Article 3

- An executive board member or any other person who executes business of an organization that receives donations or grants exceeding a certain amount*4 from Daifuku (such as a public interest incorporated foundation, a public interest incorporated association, or a non-profit corporation)

- Article 4

- The spouse or a relative within the second degree of relationship of a person who falls under any of Articles 1 to 3 above, or a relative living together with such a person

- Article 5

- A person who does not fall under any of Articles 1 to 4 above, but who is deemed likely to have a virtual conflict of interest with Daifuku due to their relationship with the company

- *1 A customer from whom Daifuku received payment of at least 2% of the amount of Daifuku’s annual consolidated net sales in the most recent fiscal year, or a business partner who received payment from Daifuku of at least 2% of the amount of its annual consolidated net sales in the most recent fiscal year

- *2 The annual average for the last three years of 10 million yen or more

- *3A shareholder with 10% or more of the voting rights

- *4The annual average for the last three years of 10 million yen or more, or 30% of the average total annual expenditure of the organization, whichever is larger

Skill matrix

The Company appoints directors by considering the optimal composition of the Board of Directors in terms of expertise, experience, diversity, etc., taking into account changes in the business environment and the management policies and business plans of the Group. Skill matrix showing the expertise and experience of each director is as follows.

Skill matrix for the fiscal year ending December 31, 2025

| Name | Independence | Expertise / Experience | ||||||

|---|---|---|---|---|---|---|---|---|

| Corporate management |

Technology | Finance, accounting |

Legal affairs, risk management |

Sales, marketing |

Global | ESG | ||

| Hiroshi Geshiro | ✔ | ✔ | ✔ | |||||

| Tomoaki Terai | ✔ | ✔ | ✔ | |||||

| Seiji Sato | ✔ | ✔ | ✔ | |||||

| Hideaki Takubo | ✔ | ✔ | ✔ | |||||

| Tetsuya Hibi | ✔ | ✔ | ✔ | |||||

| Yoshiaki Ozawa | ✔ | ✔ | ✔ | ✔ | ||||

| Keiko Kaneko | ✔ | ✔ | ✔ | ✔ | ||||

| Gideon Franklin | ✔ | ✔ | ✔ | ✔ | ||||

| Haruyuki Yoshida | ✔ | ✔ | ✔ | ✔ | ||||

| Yuki Kanzaki | ✔ | ✔ | ✔ | ✔ | ||||

Note:

In Expertise/Experience, up to three skills of individuals are marked with “✔”. The above list does not represent all of the knowledge, experience, and abilities of individuals.

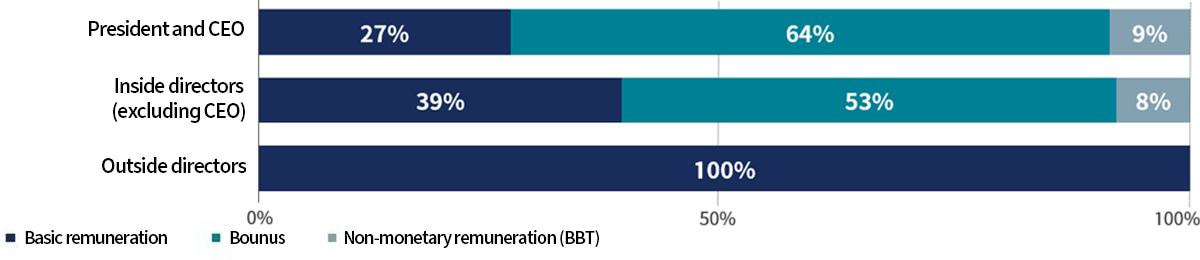

Executive remuneration

The executive remuneration consists of basic remuneration (fixed remuneration), a bonus (short-term performance-linked remuneration that is fluctuated based on performance), and medium- to long-term performance-linked equity remuneration, Board Benefit Trust (BBT). To determine annual remuneration for directors, the total amount of remuneration for individual director is resolved at a Board of Directors meeting following verification by the Advisory Committee whether it is reasonable based on levels at other comparable companies and through deliberations and reporting by the Advisory Committee.

Outline of executive remuneration

| Type of remuneration | Payment criteria | Payment method | ||||||

|---|---|---|---|---|---|---|---|---|

| Basic remuneration (fixed) | Determined according to positions and roles | Monthly Monetary remuneration |

||||||

| Performance-linked remuneration (variable)* |

Short-term assessment |

Bonus | Method of calculation of bonus resources [Total bonus resources =Consolidated net income x (1.5±0.06) %] |

Annually Monetary remuneration |

||||

| Financial indicator 1.5% of consolidated net income |

Non-financial indicators (1) Zero serious accidents: ±0.03% (Positive evaluation only if the target is achieved for five consecutive years.) (2) CO2 emissions reduction rate (progress rate toward 2030 target and initiatives in a single year) ±0.03% |

|||||||

| Description | By type | |||||||

| Basic component | Quantitative evaluation | Consolidated net income | Calculated according to positions and roles | 50% | ||||

| Performance-linked evaluation component |

Quantitative evaluation | Growth potential (rate of increase of consolidated net sales) |

Growth potential: Rate of increase of consolidated net sales compared to the previous fiscal year Profitability: Margin (business evaluation coefficient) Rate of improvement of margin compared to the previous fiscal year |

30% | ||||

| Profitability (margin) | ||||||||

| Qualitative evaluation | Roles and contributions | Calculated based on roles and contributions concerning medium- to long-term targets and strategic challenges | 20% | |||||

| Non-monetary remuneration, "Board Benefit Trust (BBT)” |

Points to be granted are determined by calculating the points according to positions and roles and the scores based on the target achievement rates (margin target achievement rate + income amount target achievement rate). | Annually Stock compensation |

||||||

| Description | By type | |||||||

| Target achievement rate for each fiscal year | Financial indicator | Consolidated net income | Rate of achievement of the initial plan [(Margin target achievement rate + income amount target achievement rate) / 2] | 100% | ||||

| Medium- to long-term assessment |

Points to be granted are determined by calculating the points according to positions and roles and the scores based on the target achievement rates (number of items) for management target items of the business plan announced before the end of the previous fiscal year. | Upon completion of the business plan Stock compensation |

||||||

| Description | By type | |||||||

| Three- or four-year business plans achievement rate |

Financial indicators | Consolidated net sales | 800.0 billion yen | 25% | ||||

| Consolidated operating margin | 11.5% | 25% | ||||||

| ROE (each fiscal year) | 13.0% | 25% | ||||||

| Non-financial indicators | ESG indicators |

|

25% | |||||

- *Outside directors and outside members of Audit & Supervisory Board members are not eligible for payment of performance-linked remuneration (variable).

- Basic remuneration

- Basic remuneration is determined based on fixed remuneration for executive remuneration by position. The remuneration level is determined based on a comprehensive consideration of qualifications, position, and company performance, while also taking into account levels at other comparable companies, and is paid monthly.

- Performance-linked remuneration—Bonus

- Bonuses are short-term performance-linked remuneration for directors and take the form of monetary remuneration to be paid at a fixed time each fiscal year, in accordance with the evaluation of performance for each fiscal year. Bonuses are calculated by setting the amount of total resources linked to consolidated net income and ESG indicators (safety and the environment) for each fiscal year, and by determining the amount to be allocated to each individual based on two factors: the basic component determined by qualification and job title, and the component of individual performance evaluated based on quantitative indicators (growth rate of net sales and margin) and qualitative indicators (such as roles and initiatives for sustainable growth). The allocation ratio is 50% basic component and 50% performance-linked evaluation component.

Consolidated net income, growth rate of net sales, margin, and improvement rate of margin are used as indicators for calculating bonuses to ensure consistency with the achievement of the Group’s management targets and to raise awareness of improving short-term performance. In addition, ESG-related indicators (achievement of occupational safety and CO2 emissions reduction targets) are used to clarify that efforts related to sustainability issues are reflected in remuneration as Company performance. - Performance-linked remuneration—non-monetary remuneration, BBT

- The BBT, a performance-linked non-monetary remuneration scheme, grants points equivalent to stocks based on performance and ESG initiatives during each fiscal year and the three- or four-year business plan period. Directors are paid Company shares and money according to accumulated points at the time of retirement. The scheme aims to further clarify the linkage of directors’ remuneration and the Company’s business performance as well as its stock value, which enables directors to share the benefit of increase in stock value and the risk of decrease in stock value with shareholders. By doing so, it is expected to raise awareness in directors to contribute to boosting corporate value in the medium and long terms.

Malus clause

For the purpose of ensuring sound management, in accordance with relevant internal rules and regulations, the Company stipulates that in the event of certain circumstances concerning directors, such director may not acquire the right to receive benefits of BBT before the vesting of the right, upon resolution of the Board of Directors.

Composition of remuneration

In light of the significant responsibility of the president and CEO for business performance, the composition of remuneration is weighted more heavily towards performance-linked remuneration than for other directors. The composition remuneration for the fiscal year ended December 31, 2024 is as follows.

Remuneration paid by type of officer for the fiscal year ended December 31, 2024

| Type of officer | Total remuneration (million yen) |

Total remuneration, etc., by type (million yen) | Number of target officers | ||

|---|---|---|---|---|---|

| Basic remuneration | Performance-linked remuneration | ||||

| Bonus | Non-monetary remuneration | ||||

| Directors (excluding outside directors) |

498 | 173 | 284 | 40 | 6 |

| Audit & Supervisory Board members (excluding outside members of the Audit & Supervisory Board) |

27 | 27 | - | - | 1 |

| Outside directors | 56 | 56 | - | - | 5 |

| Audit & Supervisory Board members (outside) | 27 | 27 | - | - | 4 |

For details of the outline and calculation method of the remuneration system for directors for the fiscal year ended December 31, 2024, see “Remuneration for officers” in our securities reports.

Securities Report

Securities Report (Japanese version)

- *The English version of the 109th Business Term Securities Report is scheduled to be disclosed in June, 2025.

Evaluation of the Board of Directors’ effectiveness

The Company regularly examines the composition and operational status of the Board of Directors and evaluates its effectiveness. The Company works to continuously strengthen functions and improve effectiveness by addressing issues identified from the evaluation results.

In the effectiveness evaluation conducted in the fiscal year ended December 31, 2024 as well, the Company ensures objectivity and independence of the effectiveness evaluation by obtaining support from an external evaluation body at key points in the process, such as conducting questionnaires and analyzing survey results. A summary of the methods and results of the Board of Directors’ effectiveness evaluation is provided below.

| Method |

|

|---|---|

| Evaluation items |

|

- [Analysis of effectiveness improvement measures and evaluation results for the issues of the fiscal year ended March 31, 2024]

- As a result of reviewing the results of the questionnaire reports, it was confirmed that the Board of Directors is functioning effectively in general.

- Regarding “reviewing the Group’s overall business portfolio from the perspective of ensuring sustainable profitability and cost of capital," the majority of respondents evaluated that they were adequately overseen. On the other hand, with regard to periodic review of the Group's overall business portfolio, some respondents indicated a need for continued consideration, such as increasing the time spent discussing medium- to long-term corporate strategy and M&A.

- With regard to “training of successor candidates,” we worked to enhance training for officers, taking into account the skills of the Board of Directors based on management strategy. In addition, the results of the questionnaire improved as a result of a resolution by the Board of Directors based on the discussion and report of the CEO and other management's succession plan by the Advisory Committee. We will continue to deepen our discussions on the ideal form of the Board of Directors and the systematic development of successors candidates to the next generation of management, based on our management strategy.

- [Recognition of issues and future initiatives]

-

- With regard to “reviewing the Group’s overall business portfolio from the perspective of ensuring sustainable profitability and cost of capital,” there was an improvement in the survey results, but we also recognized this as an issue for the fiscal year ended December 2024. The Board of Directors will seek more sophisticated management system, in light of the issues that need to be discussed with greater awareness of cost of capital and return on capital.

- Regarding the “support structure for the Board of Directors,” with the change in the members of the Board of Directors, there were opinions requesting further support for providing opportunities for interaction between outside directors only, improving the content of materials, and operations. We will continue to deepen our discussions on strengthening support systems and other measures to revitalize discussions at board meetings.

Advisory Committee

The Group has established a voluntary Advisory Committee to strengthen the independence, objectivity, and accountability of the functions of the Board of Directors regarding the nomination, dismissal, and the remuneration of directors and corporate officers. The committee is chaired by an outside director and the majority of members are outside directors.

Main agenda items for the committee meetings during the fiscal year ended December 31, 2024

- Nomination

- -Personnel matters for the General Meeting of Shareholders

- -Successor training plan

- -Personnel matters for the management

- -Corporate governance system, and other

- Remuneration

- -Implementation of ESG indicators for executive remuneration system

- -Evaluation of performance bonuses for officers and BBT

- -Verification of levels of executive remuneration, and other

- Number of meetings held in the fiscal year ended December 31, 2024

- 7 times (5 times for nomination, 2 times for remuneration)

Composition of the Advisory Committee and attendance rate at the committee meetings for the fiscal year ended December 31, 2024

| Title | Name | Attendance rate (times attended / times meetings held) |

|---|---|---|

| Outside Director | Yoshiaki Ozawa (Chair) | 100% (7/7) |

| Mineo Sakai | ||

| Kaku Kato | ||

| Keiko Kaneko | ||

| Gideon Franklin | ||

| President and CEO | Hiroshi Geshiro |

Audit & Supervisory Board

With an awareness of their fiduciary responsibilities to shareholders and with a view to continuous corporate growth and medium- and long-term improvement in corporate value, Audit & Supervisory Board members and the Audit & Supervisory Board carry out auditing activities for fulfilling their duties, including auditing of directors’ execution of duties, auditing of the internal control system, and assessment of the appropriateness of auditing conducted by the accounting auditor, in accordance with the internal regulations and the internal standards.

Main agenda items for Audit & Supervisory Board meetings during the fiscal year ended December 31, 2024

- Resolution (13 items)

- -Audit plans

- -Reappointment of accounting auditors

- -Consent to audit compensation for accounting auditors

- -Audit reports by the Audit & Supervisory Board

- -Consent to proposals for election of Audit & Supervisory Board members

- -Types of non-assurance services subject to pre-approval to be contracted to accounting auditors, and other

- Reporting (18 items)

- -Reports on the activities of the full-time Audit & Supervisory Board member and the Audit & Supervisory Board Office

- -Reports on the implementation of audits

- -Reports on the results of on-site audits of business units

- -Audit plans of the Audit Division, and other

- Deliberation and discussion (4 items)

- -Drafting audit reports of Audit & Supervisory Board members and the Audit & Supervisory Board

- -Partial revision of the remuneration system for Audit & Supervisory Board members, and other

- Number of meetings held in the fiscal year ended December 31, 2024

- 6 times

Composition of the Audit & Supervisory Board and attendance rate at Audit & Supervisory Board meetings for the fiscal year ended December 31, 2024

| Title | Name | Attendance rate (times attended / times meetings held) |

|---|---|---|

| Audit & Supervisory Board Member (full-time) | Tsukasa Saito | 100% (6/6) |

| Audit & Supervisory Board Member (outside) | Ryosuke Aihara | 100% (2/2) |

| Tsukasa Miyajima | 100% (6/6) | |

| Nobuo Wada | ||

| Eiko Hakoda | 100% (4/4) |

Notes:

- Mr. Ryosuke Aihara resigned from the office of Audit & Supervisory Board member at the conclusion of the Ordinary General Meeting of Shareholders held on June 21, 2024.

- Ms. Eiko Hakoda assumed the office of Audit & Supervisory Board member, respectively, at the conclusion of the Ordinary General Meeting of Shareholders held on June 21, 2024.

Audit & Supervisory Board Office

To enhance the effectiveness of audits conducted by Audit & Supervisory Board members and the Audit & Supervisory Board, the Company has established the Audit & Supervisory Board Office to assist with the duties of Audit & Supervisory Board members and appointed an audit officer of the same rank as a corporate officer as the general manager of the Office.

Other bodies and systems

- Audit Division

- The Audit Division reports to the Board of Directors and the Audit & Supervisory Board. Standing in a position that is independent from the business execution lines, the Audit Division conducts audits of the status of the development and operation of internal control systems in the Group.

- Management Advisory Meeting

- Management Advisory Meeting is held to confer on important management matters. With all directors and Audit & Supervisory Board members in attendance, this meeting also seeks the opinions of related corporate officers, audit officers, executives, and external specialists on an as-needed basis. The Management Advisory Meeting is convened by the President and CEO as appropriate.

- Corporate officer system

- The Company has introduced a corporate officer system to accelerate decision-making on business execution through a reduction in the number of directors as well as further revitalizing the Board of Directors by promoting more rigorous deliberations. The Company is engaging in functional and efficient business operations by broadly promoting employees with knowledge of business operations to serve as corporate officers and execute business based on the authority bestowed upon them by the Board.

- Officers meeting

- The Company holds officers meetings to review and formulate the matters to be discussed by the Board of Directors as stipulated in the Rules of the Board of Directors and reports the matters stipulated in the Rules of the Officers Meeting. The officers meeting consists of all directors and all corporate officers. It is held with the attendance of Audit & Supervisory Board members and an audit officer. The meeting is held every month in conjunction with scheduled Board of Directors meetings.

Cross-shareholding strategy

Basic policy

Our basic policy is to limit shareholdings, including shares held as cross-shareholdings, to the minimum necessary and to reduce them, and the Board of Directors confirms the status of individual holdings every year. In principle, we will no longer hold new shares for strategic purposes. Circumstances including trade relations will also be taken into consideration when the economic rationale of cross-shareholdings, such as market capitalization, book value, transaction amounts, dividends, ROE, and risk of shareholdings, is examined. Shares which the Board of Directors regards as having no significance will be sold on a timely basis.

With respect to the shares held as of December 31, 2024, the Board of Directors discussed “examination of whether to continue to hold shares as cross-shareholdings” and approved the holding of the shares at its meeting held on January 29, 2025.

In the fiscal year ended December 31, 2024, the Company reduced the holding of 16 issues of shares, including nine issues of shares sold entirely. We will decide to sell some issues of shares flexibly, keeping a close watch on the prices of the shares.

Exercise of voting rights attached to cross-shareholdings

CEO and CFO will make decisions individually with an emphasis on improving the corporate value of the cross-shareholding partners over the medium to long term. When making a judgement, special attention will be paid to whether the cross-shareholding partner has been tarnished by scandals or has committed an antisocial act. If the cross-shareholding partner were to be involved in such circumstances, the partner’s management improvement measures and audit reports shall be scrutinized.

Relationship between cross-shareholders

When a cross-shareholder indicates its intention to sell the Company’s shares, Daifuku shall not hinder the sale of the cross-held shares.

Cross-shareholdings on consolidated balance sheets

Disclosures

Basic policy for corporate governance and disclosure based on the Principles of Japan’s Corporate Governance Code

Daifuku Group Basic Policy for Corporate Governance (101 KB)

Disclosure Based on the Principles of Japan’s Corporate Governance Code (836 KB)

Reports

Corporate Governance Report (696 KB)

Shareholders Meeting

Daifuku Report

Securities Report