Corporate Governance

The Daifuku Group strives to enhance its corporate governance with the aim of ensuring the sustained growth of the Group and creating its medium- to long-term corporate value.

-

Number of directors

10Daifuku adopts a corporate officer system to accelerate management decision making on business execution and strengthen supervising functions of the Board of Directors. -

Board meeting attendance

(Outside directors: 18/18 times)

100%Daifuku prepares a year-round schedule for Board meetings and agenda. The Company conducts a functioning operation by holding the meetings in a planned manner. -

Outside officers rate

(Directors, Audit & Supervisory Board members)

40%Daifuku holds meetings among outside officers, representative directors, and full-time Audit & Supervisory Board members on a regular basis to leverage the outside officers to an effective advantage.

Principal initiatives

The Group emphasizes the fulfillment of its corporate social responsibility (CSR) based on the following management philosophy:

- Provide the best solutions to benefit the global markets and the development of society.

- Focus on healthy, growth-driven global management under a diverse and positive corporate culture.

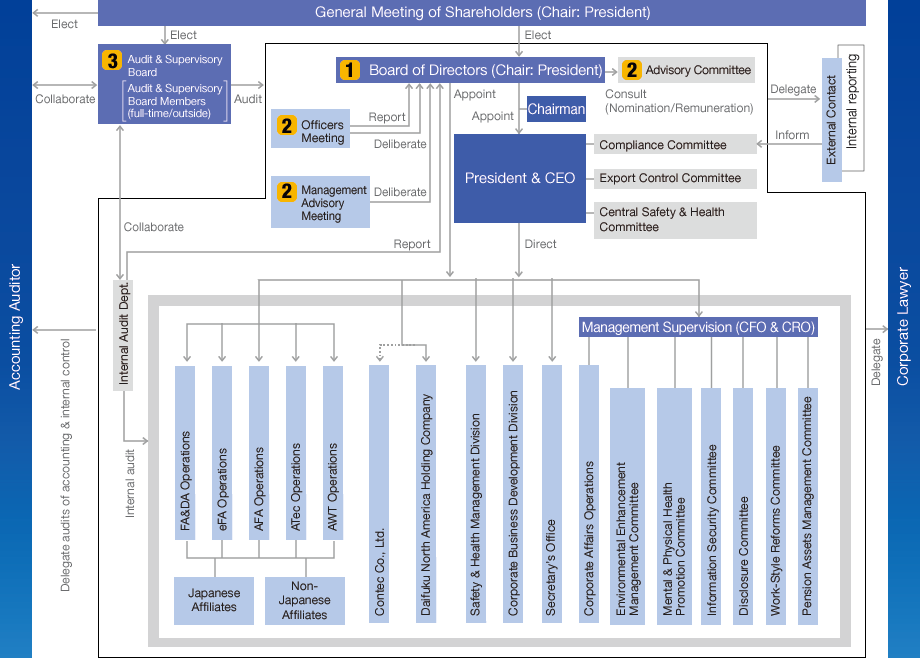

Daifuku enhances its corporate governance framework by developing the Board of Directors of 10 members, including three independent outside directors, and the Audit & Supervisory Board consisting of five members, three of whom are elected from outside the Company. The Company believes that the management oversight system functions sufficiently through the close collaboration of the two Boards. In addition, the Company has introduced the corporate officer system to encourage rapid decision making on business execution.

The Company acknowledges that a firm internal control system will make corporate governance more workable, thereby leading to enhanced corporate credibility in addition to efficient and effective operations, and will seek to ensure compliance with laws and regulations, risk management, secured assets, and credible financial reporting.

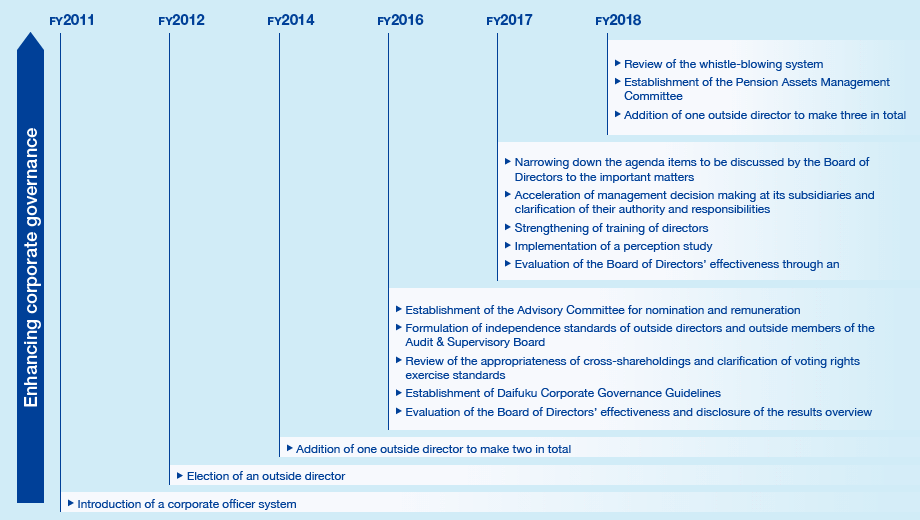

The evolution of corporate governance

The evolution of corporate governance

1 Board of Directors

The main roles and responsibilities of the Board of Directors shall be to establish the Company’s management philosophy, etc. to determine the strategic direction. It shall undertake constructive discussions about specific management policies, management plans, and other aspects.

2 System to complement functions of the Board of Directors

-

Advisory Committee

Daifuku has a voluntary Advisory Committee to deliberate on the nomination and remuneration of directors and corporate officers.

The Advisory Committee is comprised of representative directors and outside directors, and meets at least three times a year. The Advisory Committee is chaired by one of the outside directors to ensure its independence and objectivity.

-

Officers Meeting

Daifuku adopts a corporate officer system to accelerate management decision making on business execution and strengthen supervising functions of the Board of Directors. The Board of Directors delegates matters other than important matters defined in the Rules of the Board of Directors to the management team, i.e. directors and corporate officers.

With the introduction of the corporate officer system, Daifuku holds officers meetings, with all members of the management team and full-time Audit & Supervisory Board members attending and participating in deliberations on the content of business execution.

-

Management Advisory Meeting

The Management Advisory Meeting is held on a timely basis to confer important management matters, with directors and Audit & Supervisory Board members in attendance. This meeting also seeks the opinions of external specialists on an as-needed basis.

3 Audit & Supervisory Board

Audit & Supervisory Board members and the Audit & Supervisory Board shall fulfill their duties in accordance with the Rules of the Audit & Supervisory Board, among others, with regard to the audit of directors’ fulfillment of duties, decisions over resolutions to be submitted to the General Meeting of Shareholders regarding election/dismissal and non-reappointment of the accounting auditor, and others, with due attention to their fiduciary responsibilities to shareholders and with an aim for sustainable growth and medium- and long-term improvement of the corporate value.

| Independent (outside officers) |

Corporate management |

Industry insight | Overseas assignment |

Expertise | Gender | |

|---|---|---|---|---|---|---|

| Akio Tanaka | ✔ | ✔ | M | |||

| Hiroshi Geshiro | ✔ | ✔ | ✔ | M | ||

| Mikio Inohara | ✔ | ✔ | Finance/Accounting | M | ||

| Shuichi Honda | ✔ (Bank) | ✔ | ✔ | M | ||

| Hidenori Iwamoto | ✔ | ✔ | ✔ | M | ||

| Yoshiyuki Nakashima | ✔ | ✔ | ✔ | HR/General affairs | M | |

| Seiji Sato | ✔ | ✔ | ✔ | M | ||

| Noboru Kashiwagi | ✔ | ✔ | Legal | M | ||

| Yoshiaki Ozawa | ✔ | ✔ | Finance/Accounting | M | ||

| Mineo Sakai | ✔ | ✔ (IT company) | ✔ | Finance/Accounting | M |

| Name | Independent officer |

Board meeting attendance | Activity | |

|---|---|---|---|---|

| Outside directors |

Noboru Kashiwagi |

✔ |

|

Provides insightful advice and recommendations to the Board of Directors based on his abundant experience and extensive knowledge in corporate legal affairs and international trade laws. |

| Yoshiaki Ozawa |

✔ |

|

Provides expert advice and recommendations to the Board of Directors based on his extensive knowledge in finance and accounting and experience working outside of Japan. | |

| Mineo Sakai |

✔ | (Assumed office in June 2018) | Provides insightful advice and recommendations to the Board of Directors based on his abundant experience and extensive knowledge in corporate management. | |

| Outside Audit & Supervisory Board members |

Isao Kitamoto |

✔ |

|

Provides insightful advice and recommendations as a journalist to the Boards, based on extensive experience working outside of Japan. |

| Ryosuke Aihara |

✔ |

|

Provides expert advice and recommendations to the Boards, as a lawyer. | |

| Tsukasa Miyajima |

✔ | (Assumed office in June 2018) | Provides insightful advice and recommendations as a university professor specializing in legal affairs to the Boards, based on extensive experience as a legal expert. |

Performance-linked remuneration system for Board members

At the 100th Ordinary General Meeting of Shareholders in 2016, Daifuku introduced the Board Benefit Trust for inside directors and corporate officers (hereinafter referred to as the “Board members”), a performance-linked equity compensation plan. The Company pays new equity compensation to the Board members within the upper limit of remunerations (not more than 700 million yen a year).

With the introduction of the plan, the Company aims to enhance the motivation of Board members to contribute to the improvement of its business performance in the medium and long terms and to boosting its corporate value by sharing not only the benefits of rising stock value but also the risks of a decline in stock prices with its shareholders.

| Number of individuals | Remuneration | |

|---|---|---|

| Directors (Outside directors) | 10 (2) |

641 million yen (30 million yen) |

| Audit & Supervisory Board members (Outside members) | 5 (3) |

109 million yen (30 million yen) |

| Total (Outside officer total) | 15 (5) |

750 million yen (60 million yen) |

| Name | Total remuneration |

|---|---|

| Masaki Hojo | 128 million yen |

- Note:

- The listing of the total of consolidated remuneration, etc. is restricted to persons with 100 million yen or more.

Initiatives for strengthening corporate governance structure

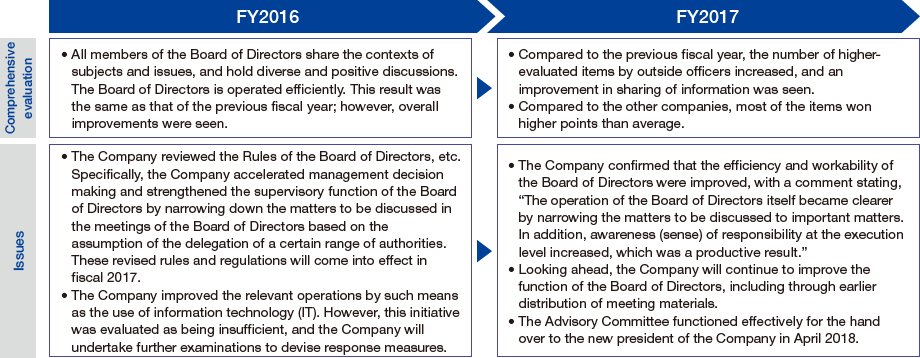

Evaluation of the Board of Directors’ effectiveness

Regarding the evaluation of the Board of Directors’ effectiveness, Daifuku has a basic policy of striving to improve its effectiveness by continuously implementing the PDCA cycle. In fiscal 2017, the Company used an external organization for evaluation of the Board of Directors’ effectiveness to ensure anonymity and collect more impartial opinions by answering directly to the organization. The results were analyzed on a perspective of a comparison with other companies.

1. Evaluation method

Step 1: The Company conducted a blank questionnaire survey of directors and Audit & Supervisory Board members concerning the Board of Directors’ effectiveness (through the external organization).

Step 2: The results of the survey were analyzed at regular meetings of representative directors, outside directors, and Audit & Supervisory Board members, and the evaluation was reported at a meeting of the Board of Directors.

2. Evaluation results

Cross-shareholding strategy

-

Daifuku reviews the appropriateness of its cross-shareholdings and reports the result at the meeting of the Board of Directors once a year.

The Company examines the economic rationale of cross-shareholdings based on market value, book value, trading conditions, ROE, among others. Accordingly, the Company is proceeding with the sale of non-significant shares.

-

Daifuku defines voting rights exercise standards for the cross-shareholdings. Presence or absence of scandals of cross-shareholding partners is mainly considered, while improvement measures for management strategy and opinions from Audit & Supervisory Board members and auditing companies of these partners are also confirmed. Finally, the Chief Financial Officer (CFO) shall assess the voting rights as to cross-shareholdings from a comprehensive perspective.

Takeover defense measures abolished

Daifuku abolished the countermeasures to guard against the attempted large-scale purchase of its shares (takeover defense measures) after its expected expiration with the closing of the Ordinary General Meeting of Shareholders in June 2018. The Company remains committed to doing its utmost to enhance its corporate value and shareholders’ common interests to further enhance its sustainable growth.

Operation status of systems to secure business appropriateness

Compliance

- Daifuku conducts regular compliance training sessions and provides case studies to foster specific understanding.

- The Company revised its internal reporting (whistle-blower) system to operate the system more effectively across the Group. The new system started in April 2018. In the new system, the Company developed environments, where a whistle-blower is able to report at ease by setting two channels, internal contact and external independent contact, which accept reporting by email. The system features anonymous reporting in multiple languages, so that every associate of the Group is able to report in their own languages.

- The Company has newly established the Pension Assets Management Committee to promote safe and effective management of its defined benefit pension plan.

System to secure the business appropriateness of the Group

- Daifuku has been accelerating management decision making at its subsidiaries and clarifying their authority and responsibilities. With respect to reporting from subsidiaries to the Company, representatives from each subsidiary report on their business conditions and other necessary information at meetings of the Board of Directors, officers meetings, global affiliate management meetings, among others, in an appropriate and timely manner.

- Daifuku has formulated its Corporate Code of Conduct as its policy toward organized crime syndicates and other anti-social forces and promotes awareness of the policy. For the prevention of bribery, the Company stipulated anti-bribery rules based on the situations and environments surrounding its subsidiaries and affiliates outside of Japan, enhances the application of the rules, and proactively conducts internal training sessions.

Audits by the Audit & Supervisory Board members

- Audit & Supervisory Board members conducted audit and supervisory activities in accordance with audit plans formulated at the beginning of the fiscal year. In the course of their duties, Audit & Supervisory Board members attended key meetings, including Board of Directors’ meetings, and visited to monitor financial activities at various operating divisions in factories, sales offices, and Group companies.

- Audit & Supervisory Board members participated in evaluation tests, which were conducted by accounting auditors, of developments, and operations of the internal control system held in Japan and accompanied audits of inventories, non-Japanese subsidiaries and affiliates, factories, and installation sites, and assessed the effectiveness of these tests and audits.

- To enhance the effectiveness of auditing, Audit & Supervisory Board members communicated with representative directors, outside directors, members of the Internal Audit Department, and accounting auditors through exchanging opinions.

Internal audits

The Internal Audit Department implemented audits for the Company and other Group companies worldwide, based on the initial audit plan formulated at the beginning of the fiscal year. With respect to the results of audits, an internal audit report was fed back to the audited divisions and submitted to representative directors and relevant officers, including full-time Audit & Supervisory Board members.

Consequently, in its fiscal 2017 internal control report, based on the Financial Instruments and Exchange Act of Japan, Daifuku once again evaluated its internal control systems over financial reporting as effective.

Dialogue with shareholders (investor relations activities)

![[FY2017 results] CFO cited as “Best CFO” (Japan) in U.S. major financial magazine: In May 2018, Daifuku was selected by Institutional Investor, one of the world’s leading U.S. financial information publications, as one of the highly ranked “Honored Companies” in “The 2018 All-Japan Executive Team” in the Engineering & Machinery sector. Among the evaluation items, Daifuku’s Mikio Inohara, Executive Vice President and CFO, took second place in the “Best CFOs” category of this sector. As a result, Daifuku ranked number four among the “Honored Companies” in the same sector.](images/governance/chrt_gov-4.png)

To contribute to sustainable growth and the increase of corporate value over the medium-to-long term for the Group, Daifuku promotes constructive dialogue with its shareholders.

The Company conducts timely and appropriate disclosure of information through the Investor Relations Department. In addition, the Company broadly pursues transparency through information disclosure on its website.

During fiscal 2017, the Company conducted a perception study to research evaluation for its business strategy and investor relations activities from its institutional investors. Through the study, an investor gave a comment, stating, “Implementing this study is a positive approach for investor relations.”