Message from the CEO

How Value Innovation Sets Us Apart

To win trust and capture growth opportunities, the Daifuku Group is continuing its initiatives to always identify markets and never dodge issues.

Fiscal 2014, the year ended March 31, 2015, was the halfway point in our four-year business plan Value Innovation 2017. Performance for the year was robust, with orders and net sales rising for the fifth consecutive year to the highest levels in our history. We have, therefore, revised our management targets for fiscal 2016, the final fiscal year of our business plan, upward, including an increase of 60 billion yen in the net sales target, to 340 billion yen.

Performance in Fiscal 2014

We reported increases in sales and income for the fifth consecutive year, marking record orders and sales.

Consolidated orders in fiscal 2014 rose 10.4% from the previous year, to 305.5 billion yen; net sales increased 10.5%, to 267.2 billion yen; operating income was up 18.5%, to 14.8 billion yen; and net income rose 26.7%, to 9.8 billion yen. We have now cleared our business plan target for the first two years of a 5% operating income ratio. Fiscal 2014 positively showed us that the foundation of our existing businesses has strengthened.

Our three core businesses, which are systems for the manufacturing and distribution sectors, the automobile sector, and the semiconductor and flat-panel display (FPD) sectors, were the keys to growth. As our customer bases for automobile production line systems and semiconductor/FPD production line systems are largely fixed, our task is to remain close to those customers and strengthen our hold in these markets. We have been satisfying customer needs through high levels of system developments and meeting deadlines, while pursuing high-quality standards through stable system utilization rates. Our initiatives have earned the strong trust of customers, and this has strengthened our position in core businesses, I believe.

Meanwhile, in manufacturing and distribution systems, demand for the introduction of high-end systems is continuing in the distribution automation (DA) business and in emerging sectors in manufacturing. In particular, the DA business includes various fields, and the composition of our customer base changes with the times. In other words, this business area will be perpetually growing. In this business, we apply our market creation business model. At Daifuku, looking ahead of markets, we develop and provide products that will be needed and technologies that will be in demand. This has placed us in a superior competitive position in the DA market and is a main factor in boosting our overall performance.

Four-Year Business Plan

Progress is ahead of expectations. We will make further leaps ahead through systems development.

Although we formulated our four-year business plan only two years ago, because of the improved business performance due to our efforts toward increasing market penetration and creating new markets, we will attain our net sales target one year ahead of schedule. Accordingly, we have revised the management targets of the plan upward.

The Internet of Things (IoT) is bringing higher demand for electronic devices and high-definition TV panels, and investment in the semiconductor and FPD sectors is rising mainly in China, Taiwan, and South Korea. Our annual sales in this field have been from 45 to 60 billion yen in recent years; however, we now expect sales of more than 80 billion yen in fiscal 2015, our record-high, as market conditions are better than anticipated. If, however, we regard this as temporary and assume it will not be recurring, I believe that structuring the framework for the “next stage in growth” over the remaining two years of the business plan will become a very significant issue.

During these two years, I want to create a company that will develop new markets, new products, and new business models to generate future profits. This will involve applying our know-how, such as non-contact power supply, into individual devices and units. The challenge for manufacturers is to increase the lineup of high-margin products with low unit prices to be sold in volume.

With regard to the IoT, what our customers need, whether it be systems for delivery centers or production lines, will not be uniform. The only common themes are analyzing Big Data and aiming for more productive systems. The difference in our customers’ needs is the issue we must address. In Daifuku’s corporate culture, rather than just think about issues, we visit our customers, interact with them, exchange ideas, and come up with solutions working with them. Through this interactive process, the overall picture becomes clearer. Rather than regarding the IoT as a general concept, we can understand and provide it as a specific service to our customers. We are aware that this can become one of our strengths that competitors cannot replicate.

| Original plan targets | Targets after revisions | |

|---|---|---|

| Net sales | ¥280 billion | ¥340 billion |

| Operating income ratio (amount) | 7% | ¥21 billion (to surpass the record-high ¥20.6 billion for fiscal 2008) |

| ROE | — | 10% |

| Non-Japan sales ratio to total sales | 60% | 70% |

Performance and Strategy by Region

Expanding in all regions, non-Japan sales now account for two-thirds of overall net sales.

Daifuku’s sales outside of Japan during fiscal 2014 amounted to 176.4 billion yen, an increase of 19.8% over the previous fiscal year. This represented 66% of overall net sales, up from 61% in fiscal 2013. Outside of Japan, manufacturing and distribution systems as a whole expanded steadily. In addition, robust demand for automobile production line systems in North America and semiconductors/FPD production line systems in Asia benefited earnings.

While sales are growing favorably, issues to be addressed still remain in increasing profitability. In this regard, Daifuku will strive to accomplish the following two initiatives.

- 1) Improving operational efficiency and productivity, and pursuing comprehensive project management and collaborative effects among non-Japan affiliates that have joined the Group in recent years

- 2) Enhancing sales and production frameworks for manufacturing and distribution systems in Southeast Asia

Another important issue is eliminating failures at project installation sites. Rather than say that there are no problems whatever at the working level, issues always arise at installation sites. What we do next, after the issues have emerged, is vital. Personally, I enjoy visiting installation sites, because, compared with listening to others describe matters, I can understand quickly where difficulties are occurring, what new initiatives we have to take, and how much trouble is being caused. In a visit to an installation site in the United States, I advised employees to have three-way teleconferences among production, technological, and installation teams in Japan and the United States on a weekly basis. I also encouraged them to continue to communicate with one another and talk about even small issues or even if no special issue needs to be discussed. Work at the installation site improved after they implemented this.

Next, I would like to summarize the status of operations by geographical area.

In North America, sales of manufacturing and distribution systems expanded significantly, backed by the effect of M&A, and demand for new installations and facility upgrades for automobile production lines remained favorable. In fiscal 2014, sales in the region expanded about 25%, to 72.5 billion yen, representing 41.1% of our overall non-Japan sales. I believe that, because of the differences in market needs between Japan and the United States, to show a profit in these businesses, it will be necessary to structure frameworks that make it possible for staff who understand local business practices to be involved throughout the process. The ideal approach would be for U.S. staff who emphasize cost control and Japanese staff who focus on precise manufacturing to collaborate in developing the market.

In Asia outside Japan, sales in fiscal 2014 rose about 9%, to 80.2 billion yen from the previous fiscal year. A major contributing factor was the increase in investments by the semiconductor and FPD sectors in China, Taiwan, and South Korea.

In South Korea, sales remained favorable, underpinned by major projects for the e-commerce and other sectors. Along with growth in national income in the Asian region as a whole, consumer needs are evolving, and my impression is that the need for high-end distribution systems, as typified by systems for the e-commerce sector, is rising. Daifuku’s high-end systems have overwhelming strengths and excel in speed, accuracy of shipments, and on-schedule deliveries.

Our position in Europe is not as strong as would be desirable, because we are dependent on some regions and industries. We are considering further market development through friendly acquisitions of leading local companies.

| Region | Fiscal 2013 | Fiscal 2014 | |||

|---|---|---|---|---|---|

| Net Sales (Billion yen) |

Composition (%) |

Net Sales (Billion yen) |

Composition (%) |

||

| North America | 57.5 | 39.2 | 72.5 | 41.1 | |

| Total for Asia outside Japan | 73.5 | 49.9 | 80.2 | 45.5 | |

| Breakdown | |||||

| South Korea | 22.2 | 15.1 | 30.5 | 17.3 | |

| China | 28.3 | 19.3 | 30.5 | 17.3 | |

| Taiwan | 7.7 | 5.2 | 6.9 | 3.9 | |

| Thailand | 7.4 | 5.1 | 5.4 | 3.1 | |

| Other | 7.7 | 5.2 | 6.7 | 3.9 | |

| Europe | 9.5 | 6.4 | 17.0 | 9.6 | |

| Latin America | 4.8 | 3.3 | 4.4 | 2.5 | |

| Other | 1.8 | 1.2 | 2.1 | 1.3 | |

| Total | 147.2 | 100.0 | 176.4 | 100.0 | |

| Note: Since figures of less than 10 million yen have been truncated, the sums of figures by region may differ from the overall total. | |||||

Aiming for Sustained Growth

Implementing farsighted initiatives that draw on Daifuku’s strengths

We position corporate governance as an important theme for a global enterprise. Looking ahead, we will actively implement measures to strengthen governance at our global subsidiaries. In specific terms, the processes of internal control and internal auditing differ from one subsidiary to another; however, I believe all our subsidiaries across the globe, as members of the Daifuku Group, to be fully compliant with laws and regulations.

Another important theme is diversity. Local nationals have been appointed as presidents not only of the companies that joined the Group through acquisition but also of Daifuku America Corporation and Daifuku Canada Inc. On the other hand, in Asia outside Japan, in part because the principal customers of the subsidiaries in this region are Japanese companies,  all of these companies are headed by Japanese presidents. However, since orders from local companies in China and elsewhere are expected to rise going forward, I believe it will be essential to appoint local management.

all of these companies are headed by Japanese presidents. However, since orders from local companies in China and elsewhere are expected to rise going forward, I believe it will be essential to appoint local management.

We also consider it to be extremely important to increase diversity at our workplaces where everyone is able to use their capabilities to the fullest. For Daifuku, one theme is how it can support the activities of all employees.

With respect to corporate social responsibility (CSR) activities, Daifuku’s largest establishment, which is located in the vicinity of Lake Biwa, Japan’s largest body of fresh water, and is surrounded by a verdant area, has had a major impact on our view of CSR. Under the Company’s CSR policy, our employees have a high level of awareness toward nature and the environment.

Allocation of Income

Striving to attain sustained growth as a company capable of generating a 10% ratio of operating income to sales

We believe that the ideal allocation of income is to provide one-third each to employees and shareholders, and use the remaining one-third for investing in Daifuku’s future growth. In the medium-to-long term, we will give consideration to the balance between dividends to shareholders and investments for growth; however, at present,  we consider preference should be given to investment for growth.

we consider preference should be given to investment for growth.

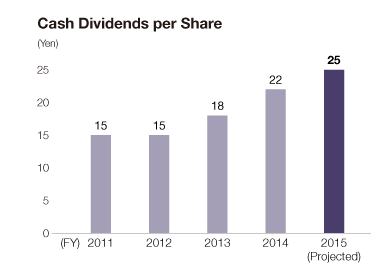

Under our four-year business plan Value Innovation 2017, we have indicated that we will aim for sustained growth in dividends per share and then for a 30% dividend payout ratio from consolidated net income in the medium-to-long term. Based on this policy, we declared a dividend of 22 yen per share for fiscal 2014. For fiscal 2015, we are planning to pay an interim dividend of 10 yen per share, followed by a 15 yen per share year-end dividend, bringing the total dividend for the fiscal year to 25 yen per share.

To strengthen our financial position, we have issued convertible bonds and, as mentioned previously, we have set a goal of a 10% return on equity in our business plan and will aim to maintain and improve our bond rating of single-A. We have also set a goal of having Daifuku’s stock included in the JPX-Nikkei Index 400 and are working to raise our three-year average ROE, increase our three-year accumulated operating income, and raise our market capitalization.

The Management and Corporate Culture I Aim to Cultivate

Differentiating Daifuku as an enterprise that never dodges issues and

always innovates for greater customer value

In the Daifuku corporate culture, employees are earnest and sincere in their work. No matter what difficulties we encounter, we never dodge them, but help one another. We overcome issues that arise at installation sites, and always endeavor to delight our customers by delivering on time and starting up their facilities on schedule. I believe this has led our performance in serving customers and society. Outside of Japan also, Daifuku has won a reputation as an enterprise that will always do things to the very end. This corporate culture is a philosophy that Daifuku has always treasured. So long as we have our corporate principle of “never dodging issues, but address them forthrightly while helping one another,” I am convinced that we can overcome even the roughest times that the future may bring. I would like us to increase the strengths of the Daifuku Group even further to respond to the expectations that you, as shareholders who have supported us, have for our future performance.

Masaki Hojo

President and CEO

Daifuku Co., Ltd.

VALUE GROWTH ENGINE Major Topics in Fiscal 2014

New Zealand’s BCS Joins the Daifuku Family

In December 2014, Daifuku purchased 80% of the outstanding shares the BCS Group Limited (headquartered in New Zealand), which became a subsidiary of the Daifuku Group. BCS is the leading company in sales in the Oceanian market for airport baggage handling systems and is expanding its business activities into Southeast Asia. BCS offers IT-based solutions through its software that incorporates a software package with three functions of SCADA,* 3D simulator, and testing tool. With the entry of BCS into the Group, Daifuku now has the network needed for intensive coverage of Oceania, where it has delivered only a few systems thus far, and the rest of the Asian market, where expansion in airport construction is forecast. Daifuku will seek benefits from the collaboration of BCS and other Group companies that cover the airport baggage handling systems business in the North America and Europe regions, and the expansion into the logistics systems business in BCS’s sales territory.

* SCADA, standing for supervisory control and data acquisition, is a type of control and monitoring system.

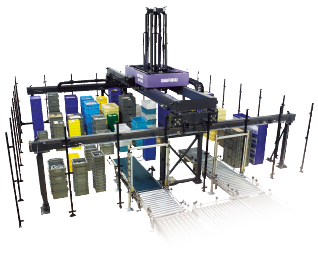

Wynright’s robot technology playing an active role in the DA sector

North American Holding Company Renamed and Brands Unified

In January 2015, the name of Daifuku Webb Holding Company was changed to Daifuku North America Holding Company (headquartered in Michigan, U.S.A.). Four affiliates, including Wynright Corporation, are now operating under Daifuku North America and expanding the scope of their operations. The brand name DAIFUKU WEBB, used heretofore, will be replaced, and all products will bear the DAIFUKU brand, with the aim of strengthening the DAIFUKU brand at the global level, including North America, where future growth is expected.

Innovative Temporary Storage and Sortation System “SPDR (Pronounced Spider)” Developed

Daifuku developed the SPDR temporary storage and sortation system to meet the workplace logistics needs of automobile and automotive parts manufacturers. Marketing of this system began in December 2014. The system adopts an original structural design, and it is the first system of its kind in the world that makes it possible to handle cases of varying sizes. The system is also designed to respond to individual facility needs, such as the efficient use of space, short installation and start-up time, and allowing for layout changes after installation. This system makes the receipt, storage, and shipment of parts, which formerly depended on human labor, much more efficient and flexible.