Corporate Governance

Principal Initiatives

Daifuku is fulfilling the sustained growth of its corporate value and the corporate social responsibility (CSR) based on the key tenets of its management philosophy: to “provide the best solutions to benefit the global markets and the development of society” and “focus on healthy, growth-driven global management under a diverse and positive corporate culture.” The Company ceaselessly strives to improve its corporate governance, the platform supporting the realization of this mission.

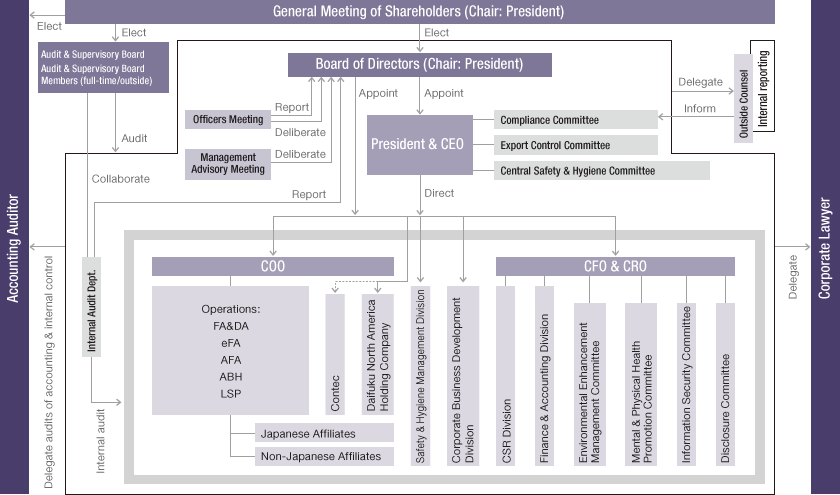

Management Decision Making, Supervision, and Business Execution Framework

Corporate Governance Structure

Board of Directors

Daifuku’s Board of Directors consists of 10 directors, including two outside directors. The directors’ term of office is one year, and each Board member’s mandate is reviewed yearly at the General Meeting of Shareholders. The Board of Directors pursues decision making on important management matters, including management policies. The Board of Directors’ regular meetings are held once a month, while extraordinary meetings are held as needed (six times in the fiscal year ended March 31, 2015).

Daifuku also holds the Management Advisory Meeting* (five times in the fiscal year ended March 31, 2015), which comprises all directors with Audit and Supervisory Board members in attendance, to discuss important management matters and make recommendations to the Board of Directors.

The corporate officer system* is in place to accelerate management decision making and execution. The Company currently maintains 19 corporate officers, including those serving concurrently as directors.

* Corporate officer systems and Management Advisory Meetings within companies that have an audit and supervisory board are voluntary corporate bodies, not specified in Japan’s Companies Act.

Outside directors

Two outside directors provide insightful advice and recommendations to the Board of Directors based on their abundant experience and extensive knowledge in international trade laws, corporate legal affairs, finance, and accounting.

| Name | Board meeting attendance |

Activity |

|---|---|---|

| Noboru Kashiwagi | Regular: 12/12 times Special: 6/6 times |

Provides insightful advice and recommendations to the Board of Directors based on his abundant experience and extensive knowledge in corporate legal affairs and international trade laws. |

| Yoshiaki Ozawa | Regular: 7/9 times Special: 4/4 times |

Provides expert advice and recommendations to the Board of Directors based on his extensive knowledge in finance and accounting and experience working outside of Japan. |

Audit and Supervisory Board

Daifuku maintains an Audit and Supervisory Board made up of five Audit and Supervisory Board members, three of whom are elected from outside the Company. The Audit and Supervisory Board met on six occasions during the fiscal year ended March 31, 2015.

Audit and Supervisory Board members conduct audit and supervisory activities in accordance with audit plans formulated at the beginning of the fiscal year. In the course of their duties, Audit and Supervisory Board members attend key meetings, including Board of Directors’ meetings and officers’ meetings, and visit to monitor financial activities at various operating divisions in factories, sales offices, and Group companies. To promote coordination and effectiveness in auditing, Audit and Supervisory Board members exchange information and conduct business audits in coordination with the Internal Audit Department, which is independent of the regular business operations, and, together with accounting auditors, make inspection visits, exchange opinions about audit plans and results, and attend evaluation tests of internal control systems.

Outside Audit and Supervisory Board members

Three outside Audit and Supervisory Board members—Harumichi Uchida, Isao Kitamoto, and Hiroyuki Torii—bring diverse perspectives to the Audit and Supervisory Board by exchanging opinions with the full-time Audit and Supervisory Board members, attending Board of Directors’ meetings, and gathering information. Along with the previously mentioned outside director, the Tokyo Stock Exchange has been notified that two of the outside Audit and Supervisory Board members, Isao Kitamoto and Hiroyuki Torii, are independent officers.

| Name | Board meeting attendance |

Activity |

|---|---|---|

| Harumichi Uchida | Board of Directors Regular: 11/12 times Special: 6/6 times Audit and Supervisory Board: 6/6 times |

Provides expert advice and recommendations to the Boards as a prominent lawyer. |

| Isao Kitamoto | Board of Directors Regular: 12/12 times Special: 6/6 times Audit and Supervisory Board: 6/6 times |

Provides insightful advice and recommendations as a journalist to the Boards, based on extensive experience working outside of Japan. |

| Hiroyuki Torii | Board of Directors Regular: 12/12 times Special: 6/6 times Audit and Supervisory Board: 6/6 times |

Provides insightful advice and recommendations as a journalist to the Boards, based on a wealth of knowledge in the science and technology fields. |

Accounting auditor

Daifuku provides proper management and financial information to be audited from a fair and unbiased perspective by the accounting auditor, PricewaterhouseCoopers Aarata, with which the Company signed an audit contract.

Board Member Compensation

At Daifuku’s June 2006 General Meeting of Shareholders, a resolution was passed limiting the total annual compensation of directors (excluding the salaries of staff) to 700 million yen, and that of Audit and Supervisory Board members to 110 million yen. Director and Audit and Supervisory Board member compensation in fiscal 2014 is as shown in the following table. No individual received total compensation on a consolidated basis of 100 million yen or more, nor did any individual outside officer receive compensation as a director or Audit and Supervisory Board member from Daifuku’s subsidiaries besides that shown in the table.

| Category | Number of individuals |

Compensation |

|---|---|---|

| Directors (Outside directors) |

12 (2) |

435 million yen (24 million yen) |

| Audit and Supervisory Board members (Outside Audit and Supervisory Board members) |

6 (3) |

86 million yen (30 million yen) |

| Total (Outside officer total) |

18 (5) |

521 million yen (54 million yen) |

Enhancing Corporate Governance Effectiveness

Daifuku develops systems mainly for its internal control, compliance, and risk management with the aim of raising the effectiveness of corporate governance as well as corporate trustworthiness and operational efficiency.

Internal control system

Daifuku operates its internal control system in compliance with Japan’s Companies Act. The Internal Audit Department, which plays a major role in the Company, supports every operating division to build their internal control system mainly for ensuring reliable financial reporting, by assessing risks in various business activities. In addition, the department conducts integrated management using Plan-Do-Check-Act cycles on internal control systems by evaluating the internal control developments and operational effectiveness conducted by internal inspectors, who were appointed from non-Internal audit departments.

Compliance

Daifuku has established a Compliance Committee chaired by the president, of which all directors are members, to monitor and supervise legal and other compliance initiatives. The combined CFO (chief financial officer) and CRO (chief risk officer) communicates with all directors and employees to ensure compliance with the Corporate Code of Conduct.

As part of its efforts, the Company holds training sessions companywide to raise awareness of compliance in all of its employees. In addition, as a countermeasure against the global risk of violating laws, the Company has established basic company rules and subsidiary rules detailing various measures and procedures to comply with competition and bribery laws. Daifuku has also distributed a message from the president conveying the importance of compliance to all employees.

Risk management

Daifuku implements risk management measures through the CSR Division under the control of the CRO. Under the Company’s risk management rules, the division conducts risk assessments across the Daifuku Group once a year. According to the level of risk criticality, related divisions take measures to mitigate and minimize risks. Daifuku also strengthens emergency response structures to communicate within the Group in a speedy and appropriate manner.

Consequently, in its fiscal 2014 internal control report, based on the Financial Instruments and Exchange Act of Japan, Daifuku once again evaluated its internal control systems over financial reporting as effective.

Information Disclosure and IR Activities

For its shareholders and investors, Daifuku conducts timely and appropriate disclosure of information in accordance with laws and regulations, through its IR (Investor Relations) Department. For security analysts and institutional investors, the Company conducts IR activities, such as quarterly results briefings, additional company information sessions as needed, and conference calls, and responds to individual requests for information through the department.

In addition, Daifuku has sent notice of the Ordinary General Meeting of Shareholders and posted Japanese and English versions of the notice on its website earlier than last year.

For individual investors, Daifuku broadly pursues transparency through tours of its facilities, various IR events and publications, and timely information disclosure on its website.

Corporate Governance Code

Daifuku will continue to seriously discuss the essence of Japan’s Corporate Governance Code, which was applied in June 2015, to increase its corporate value. As one of its efforts, the Company added the targeted ROE as a management indicator to its four-year business plan Value Innovation 2017. The Company will submit its renewed report that contains its activities to the Tokyo Stock Exchange to meet the Code before the end of 2015.

TOPICS

Role-play training for large-scale disasters

In September 2014, Daifuku implemented a role-play training that simulated a scenario of a large earthquake at the Shiga Works for the first time, aimed at raising employees’ response capabilities in emergency. About 1,700 employees from all factories participated in the practical training, which responds to unexpected events. This training will be regularly held to increase such response capabilities in the event of disasters.

In September 2014, Daifuku implemented a role-play training that simulated a scenario of a large earthquake at the Shiga Works for the first time, aimed at raising employees’ response capabilities in emergency. About 1,700 employees from all factories participated in the practical training, which responds to unexpected events. This training will be regularly held to increase such response capabilities in the event of disasters.