Special Feature

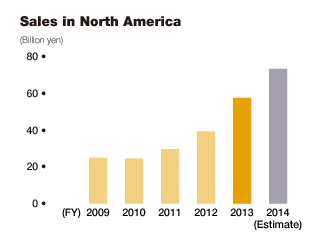

The Americas

Creating early benefits with the companies

that joined the Daifuku Group and increasing profitability

of businesses in a growing North American market

Market Analysis and Trends by Product Area

Daifuku established Daifuku U.S.A. Inc. (currently, Daifuku America Corporation) in 1983 as Japanese automakers, its major customers, were entering the U.S. market and has subsequently further developed its business activities through M&A. At present, wholly owned subsidiary Daifuku Webb Holding Company oversees operations in North America. To accommodate the needs of customers, the majority of which are locally based companies, Daifuku is enhancing its human resource training and personnel management systems to prepare for management led by local staff. Trends in principal markets and Daifuku’s accomplishments are as follows.

Manufacturers and distributors: In the U.S. market, the time required to recover capital investments is relatively short, and investments with a short time horizon are predominant. Accordingly, it is necessary to show customers the specific advantages in terms of direct impacts in the short term on their businesses including automation, energy conservation, labor saving, and other areas. Talking points must focus around how investments will differentiate customers from their competitors, how operations can be accelerated, how precision will be increased, and other benefits. In the United States, which has a large landmass and a growing population, Daifuku expects expansion in the logistics markets, and the outlook is for growth in demand for material handling systems, such as conveyor, sorter, and picking systems.

Semiconductors: Orders began to recover in the latter half of fiscal 2013. In this sector, where customers tend to remain loyal to specific vendors, Daifuku’s proprietary nitrogen purge stockers benefited earnings.

Automobiles: In addition to the increased demand for facility upgrades, including those for major projects, orders are favorable among Detroit’s Three automakers. In addition, demand for system upgrades from Japanese automakers in the region remains firm.

Airports: Demand in the North American airport market in fiscal 2013 shrank 40% from the previous year, and, because of the shortage of orders, strict business operations are necessary. However, demand related to tightening security measures is expected going forward, and profitability will increase with the implementation of cost-cutting measures.

Growth Strategies

Beginning with the current fiscal year, Daifuku senior management will exercise more-direct control of the North American market. Daifuku will make effective use of existing sales channels of Wynright Corporation, which joined the Group in October 2013. Also, Daifuku, with strengths in the automated warehouse field, will collaborate with Wynright, which has strengths in roller conveyors, to market their complementary product lineups. Marketing activities will focus on expanding sales, mainly to the distribution sector. Wynright, which forecasts more than 20.0 billion yen in sales in fiscal 2014, has two factories and 18 sales and service centers, where more than 200 engineers are engaged in projects, in the United States. Wynright operations encompass from design to manufacturing, installation, sales, and after-sales service, and it has delivered systems to many well-known companies. Wynright has developed robotic technology for truck loading/unloading, where automation has largely remained untouched, in distribution centers.

The president of Daifuku Webb serves as the general manager of Daifuku’s airport business and oversees operations across the globe, and activities to strengthen management in Europe and Asia are in progress.

Wynright Tech Center

Wynright Tech Center

Wynright’s warehouse robotic technology

Wynright’s warehouse robotic technology

Daifuku Webb boasts the largest-scale market share in North America in terms of operation and maintenance for airport facilities.

Daifuku Webb boasts the largest-scale market share in North America in terms of operation and maintenance for airport facilities.

Case Study | United States

SKECHERS distribution center

SKECHERS distribution center

Throughput doubled through consolidation of distribution centers: Casual footwear company SKECHERS

Wynright undertook the design as a systems integrator for the material handling systems of a distribution center for SKECHERS USA, Inc., headquartered in California, which included conveyors, sorters, and pallet racks. In addition, Daifuku Webb delivered mini load automated storage and retrieval systems (56 stacker cranes, 363,000 storage locations). SKECHERS USA consolidated five distribution centers into one in the United States, resulting in a double throughput with half the labor. The system was designed to be expandable to handle a higher volume of products.

Special Feature

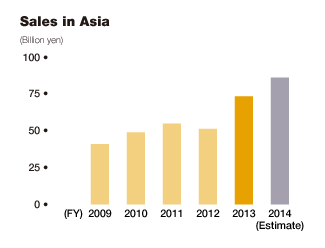

Asia

Accommodating the needs for structuring safe and reliable logistics networks and for automated systems to accommodate rising wage costs, brought by a growing middle-income class in Asia

Market Analysis and Trends by Product Area

China

Daifuku’s sales in the Chinese market are expanding at a high and steady pace. China’s 12th Five-Year Plan (covering the period from 2011 to 2015) contains measures for promoting the sophistication of the industrial structure, including investments in warehousing and delivery centers. The plan also calls for the development of supply chain management systems for the manufacturing sector and urban delivery systems, including systems for chilled food products. These investments are expected to continue into the future.

Manufacturers and distributors: Demand for systems for the food, pharmaceutical, beverage, and paper factories and supermarket logistics is expanding rapidly. Daifuku has received orders for high-throughput sorting systems from four retailers that rank within the top 10 Chinese retailing companies.

Semiconductors and FPDs: Daifuku forecasts major gains in both orders and sales of systems for flat-panel display (FPD) factories in fiscal 2014. In 2013, Daifuku (Suzhou) Cleanroom Automation Co., Ltd. went into operation, strengthening local production and procurement systems.

Automobiles: In fiscal 2013, Daifuku (China) Co., Ltd. received orders from Chinese as well as Western automakers, with signs of buoyed investment by Japanese automakers. In addition, the SmartCart, an automatic guided cart developed by Daifuku Webb, is now being manufactured in China and was delivered to non-Chinese automakers in the nation.

South Korea

In systems for semiconductor and FPD factories, Daifuku’s subsidiary Clean Factomation, Inc. is experiencing strong growth and, with its originally developed products, sales to South Korean companies are robust.

With respect to systems for automobile factories, Daifuku Korea Co., Ltd. is undertaking projects for South Korean automakers both in their home country and their plants in China and other countries. Sales in this business in fiscal 2013 rose to a new record level.

In systems for manufacturers and distributors in South Korea, Daifuku recorded orders received mainly from the e-commerce related sector.

Taiwan

In Taiwan’s semiconductor and FPD market, Daifuku has secured a solid customer base among leading companies and continues to further build customer relationships.

In systems for manufacturers and distributors in Taiwan, Daifuku has received orders from the paper and distribution sectors as well as touch-panel manufacturers.

ASEAN

ASEAN is the region where the most growth is expected in systems for manufacturers and distributors, especially in the food and retailing sectors. Daifuku strives to strengthen its position in the ASEAN region through implementing a number of strategies, such as assigning specialists to these markets, developing additional sales channels, and increasing productivity in Thailand.

Daifuku Mechatronics (Singapore) Pte. Ltd. has trained top-quality software engineers, and their accomplishments include the development of original RFID systems. Daifuku Singapore has also been successful in developing business outside the material handling field, including the hotels and restaurants sector. In Malaysia, amid growing concerns about health, demand in systems for handling mushrooms, drinking water, and other products is expanding.

In systems for automobile factories, investments by Japanese automakers mainly in Thailand and Indonesia are robust. Especially in Thailand, Daifuku’s quick response to the flooding in 2011 has been highly appraised by customers, and has led to the receipt of additional orders.

Growth Strategies

Competition with other Japanese and European systems manufacturers is growing more intense. For this reason, Daifuku is strengthening its local presence in Asian markets by assigning specialists to these areas to expand its presence in the manufacturing and distribution sectors. In addition, to deal effectively with the growth of locally based competitors, Daifuku is moving forward with production and procurement in the local markets and introducing high- value-added products to differentiate from competitors’ products.

Daifuku Logan’s baggage handling systems are used at Kunming Airport

Daifuku Logan’s baggage handling systems are used at Kunming Airport

Cleanroom transport systems for FPD factories

Cleanroom transport systems for FPD factories

Automobile factory in Thailand

Automobile factory in Thailand

Daifuku Singapore exhibits at a local trade fair

Daifuku Singapore exhibits at a local trade fair

Case Study | China

Dongfeng Honda Automobile Co., Ltd.

Dongfeng Honda Automobile Co., Ltd.

Dongfeng Honda Automobile’s second plant: Honda’s joint venture company in China adopting Daifuku technology

Dongfeng Honda Automobile Co., Ltd., Honda Motor Co., Ltd.’s automobile production and sales joint venture in China, built a second plant to increase its production capacity in China. The new factory adopts Daifuku’s latest systems throughout its facility, substantially increasing productivity. The factory represents a successful realization of Honda’s aim of creating a highly efficient facility that is people-friendly. The automobile assembly lines incorporate Daifuku’s Flexible Assembly Leveling System (FALS) in all processes. FALS is a full pallet conveyor system that allows for adjustments of the car platform (chassis) to desired heights so workers can ergonomically perform their tasks, thus greatly reducing physical stress and fatigue.