Message from the CEO

Becoming

the Truly Global Leader

in Material Handling

under “Value Innovation 2020”

- Fiscal 2012 vs. Fiscal 2016

- Net sales

+58.6% - Operating income

+188.4% - ROE

+7.0pt

Review of Fiscal 2016 and the “Value Innovation 2017” Business Plan

We achieved all of our medium-term business plan targets except for net sales, which was affected by the strong yen. Our distribution automation (DA) business expanded in Japan, enhancing our earning capacity, and generating record highs for operating income for two consecutive years.

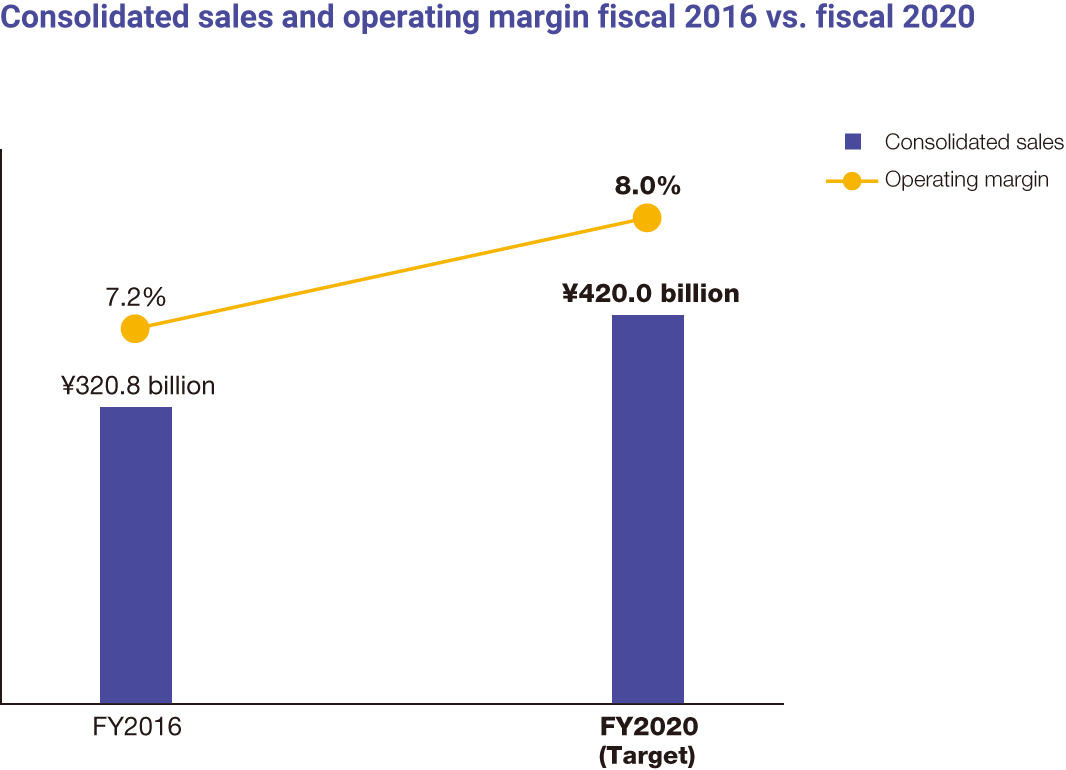

Consolidated orders in fiscal 2016 ended March 31, 2017 declined 0.8% from the previous fiscal year, to 356.5 billion yen, with net sales down 4.6%, to 320.8 billion yen. Operating income, however, rose 10.6%, to 23.0 billion yen, with net income attributable to shareholders of the parent company up 22.7%, to 16.7 billion yen. As a result, compared to the business plan targets of net sales of 340 billion yen, operating income of 21.0 billion yen, and ROE of 10% or higher, we achieved the targets for both operating income and ROE, while net sales were affected by the strong yen. The main factor in this was the extremely active investment in Japan by distributors in line with the growth and development of e-commerce. In Japan, our production has been increasingly efficient with personnel and other aspects, making the DA business an earnings driver in terms of both quantitative expansion and the multiplier effect.

Looking back on the four years of the Value Innovation 2017 business plan, I believe we managed to largely achieve our goal of strengthening existing businesses. In the DA business, we not only expanded existing business, but broadened our customer base with new customers. Also, there are no other material handling companies anywhere in the world with operations in the three sectors—manufacturing and distribution systems, semiconductor and flat-panel display (FPD) production line systems, and automobile production line systems. In the semiconductor and FPD sectors, Daifuku benefits from the “Made in Japan” reputation for quality, and has gained a high market share. The inclusion of airport technologies along with these sectors is another of Daifuku’s major strengths. With these comprehensive capabilities, we achieved a position as the global industry leader in revenue for three consecutive years, however, catching up with the top company in manufacturing and distribution systems, which is our mainstay business, will allow us to become the truly global leader in material handling.

On the other hand, in terms of developing new business models and identifying new businesses, while we have had some initial success, these have yet to produce sufficient results. The new business plan, Value Innovation 2020, will continue various measures to open new markets, including establishing distinctive business models, developing new technologies, and M&A with companies possessing unique technologies.

In particular, we are focusing on innovation in material handling systems as part of the “smart logistics” concept, and will continue to advance the Airport Technologies segment as one of four core businesses. (See the Special Feature for details.)

| (Billion yen) | ||

| Final FY Target | FY 2016 | |

|---|---|---|

| Net sales | ¥340.0 | ¥320.8 |

| Operating income | ¥21.0 | ¥23.0 |

| ROE | 10% or higher | 12.6% |

The New “Value Innovation 2020” Business Plan and Its 10-Year Vision

With the aim to be the truly global leader in material handling, using new technologies and by providing new solutions, we will increase system quality and enhance value for customers.

The new four-year business plan launched in April 2017, “Value Innovation 2020,” was formulated in a way that also takes into account a vision of our future after 10 years, where it will be crucial for us to work with e-commerce. Going forward, we believe that there will be a change from business-to-consumer (B2C), where companies guide ordinary consumers, to the consumer-to-business (C2B) model that will become the mainstream, with the needs of ordinary consumers guiding companies. For B2B companies such as Daifuku to survive, we need to remain conscious of the consumer trends facing our customers.

Managers in leading C2B companies are extremely quick in decision making and management, maybe 10 times faster than our Company. By the time we decide on a course of action, they are already thinking three years ahead, with many brilliant ideas being generated. In dealing with companies led by such top managers, we need to be constantly thinking of the next step in both business and management. Safety and stability are, of course, paramount, but that alone will not allow us to survive the competition. We need to constantly set challenges for ourselves.

We do not make robots or sensors, but we have more expertise than any other company in equipment, devices, and efficient and effective applications that large distribution centers need. Quality is not in the product itself, but in taking a broader view of the structure, and incorporating various applications, enhancing the quality of the overall system.

In semiconductors as well, our business benefits from a strong tailwind. This is because automobiles now incorporate a lot more electronics. The Internet of Things (IoT) and artificial intelligence (AI) will further accelerate this trend. Self-driving cars can be considered a type of IoT. The volatility that typified the semiconductor industry when it relied on personal computers alone will fade, accordingly.

Due to IoT and AI, our business will change. One example is the collection and analysis of system operating data to provide preventative maintenance services. We will be able to analyze the problems that occur in system operations at an early stage, and respond accordingly. Inferring the cause from the result is exceedingly imprecise. The ability to recreate visually what happened, and the circumstances at the moment it occurred, will allow us to discern the true cause.

When I was a salesperson for automotive production line systems, a customer told me that for every minute the line stopped, production volume fell by one vehicle. An hour’s stoppage meant 60 fewer vehicles, with losses in the hundreds of millions of yen. Disruption to automobile and semiconductor production line systems cannot be tolerated. When discussing this with the head of an e-commerce company, he mentioned how an interruption in the distribution system is a huge problem for them as well. He pointed out that unlike automobile factories, even when the line stops, customer orders just keep coming, building to a volume that cannot even begin to compare with one vehicle per minute. Ensuring that nothing causes a system failure or stoppage has taken on an even greater significance.

Returning to the issue of IoT and AI, Japan’s Ministry of Land, Infrastructure, Transport and Tourism and the transport industry are moving toward the creation of an efficient delivery system, and the practical application of self-driving vehicles. I believe that, as a leading manufacturer, we also need to be involved in such efforts from the standpoint of material handling.

An Optimal Corporate Governance System for Localization and Globalization

We aim to establish the best corporate governance structure for the Daifuku Group.

One of the aims of the new business plan is to “pursue the best combination of localization and globalization.” This means establishing an optimal corporate governance system to realize further growth outside Japan. During fiscal 2017, the Group plans to have about 9,400 employees, of which 62%, or about 5,800, will work at non-Japanese affiliates. On-site staff are vital to developing business with local customers. That is why we need to strengthen localization, but, without sufficient oversight, the overall governance of the corporate group will be ineffective. To prevent this, it is important for those affiliates to continually share information with Japan, and to adapt the new products and solutions originating from Japan for local markets.

Another of Daifuku’s social responsibilities is “safety.” Top management in the global manufacturing industry is keenly aware of safety, and Daifuku is no exception, conducting business with a consistent focus on safety. At the same time, governance in Japan has a close association with compliance, and, once a company causes a scandal, it loses its continuation value. We consistently strive to raise awareness of compliance among employees. (See the Discussion Between the President and Outside Directors for details.)

Another of Daifuku’s social responsibilities is “safety.” Top management in the global manufacturing industry is keenly aware of safety, and Daifuku is no exception, conducting business with a consistent focus on safety. At the same time, governance in Japan has a close association with compliance, and, once a company causes a scandal, it loses its continuation value. We consistently strive to raise awareness of compliance among employees. (See the Discussion Between the President and Outside Directors for details.)

Daifuku’s Distinctive DNA and Sustainable Growth

Building trust with customers is part of Daifuku’s corporate DNA, and the first key to sustainable growth.

The starting point for Daifuku’s business is responding sincerely to the various needs and wants of customers. Examples of our products being a world or industry first, are far from rare. When a customer believes that our system is an effective means to meet their needs, we are able to build a long-term relationship of trust, allowing for further growth.

This is the positive culture and DNA that Daifuku has built over its 80-year history. The earnings provided by growth are, of course, important, but I believe that focusing too much on earnings causes companies to lose sight of their essence. The morale of salespersons and engineers in direct contact with customers is extremely high, and the trust placed in Daifuku is the source of their energy, and therefore our sustainable growth. Going forward, Daifuku will continue to develop its unique culture, cultivate markets by providing optimal solutions, and contribute to the advancement of customers and societies around the world. Thank you for your continued support.

Masaki Hojo

President and CEO

Daifuku Co., Ltd.