Special Feature

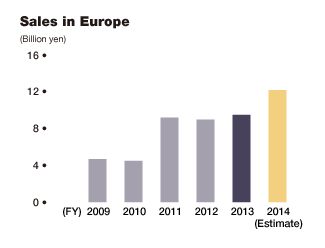

Europe

Pursuing a localization strategy in the midst of severe competition and strengthening systems to respond to regional characteristics

Market Analysis and Trends by Product Area

Competition in this region is challenging, as many leading material handling equipment manufacturers are active in Europe. Amid this operating environment, Daifuku is collaborating with leading dealers in the region and striving to raise its profile in the European market. In comparison with the United States, customers in Europe place greater emphasis on worker-friendly and environmental issues. In Japan, the trend is to have systems that include both people and machines, whereas the trend in Europe emphasizes creating worker-free automation systems. Daifuku works to meet the diversified needs of various regions to grow into a global leading company.

Growth Strategies

In northern Europe, Daifuku has been highly appraised for its installations and after-sales service to leading supermarkets in Sweden and Denmark. As a result, Daifuku has increasingly been selected as the systems integrator for expansions of distribution centers. In Russia, the Company installed systems at a major distribution center for footwear. Daifuku will continue to address the challenge of generating a stable flow of similarly large projects.

Meanwhile, in southern Europe, the relationship of more than 25 years with ULMA Handling Systems in Spain has resulted in a stable record of success. ULMA provides sales and services for Daifuku’s stacker cranes, principally in Spain, Portugal, France, and Brazil.

In central Europe, Daifuku entered a business partnership with Austria-based Knapp AG in 2010 for logistics systems. Knapp has strengths in the handling of small objects, including pharmaceuticals and cosmetics. In 2012, Knapp became an equity-method affiliate of Daifuku.

Daifuku is also working to improve its performance in the airport sector, where challenging business conditions have persisted. Currently, Daifuku Logan Ltd. aims to win orders in the United Kingdom by taking advantage of the products developed in Japan.

Daifuku is placing emphasis on the training and development of affiliate staff to push for the localization of management in Europe as a whole.

Case Study | Sweden

ICA distribution center

ICA distribution center

Attaining higher efficiency with Daifuku’s automated systems: Distribution center for ICA, Scandinavia’s largest supermarket chain

ICA Sverige AB, a supermarket headquartered in Stockholm, Sweden, which provides quality goods at reasonable prices, has more than 2,100 stores in northern Europe. ICA consolidated nine warehouses into a single distribution center. The new facility, which has an area of 70,000 square meters, now operates as a comprehensive distribution center, handling more than 5,000 different items. Daifuku’s material handling systems in the center include automated storage and retrieval systems, conveyors, heavy-duty racks, and sorting systems. With these systems, the distribution center was significantly automated, allowing it to handle a wide variety of goods quickly and at low cost.

Special Feature

Japan

Further bolstering R&D, the foundation for future growth, and demonstrating Daifuku’s strengths even in the mature market of Japan

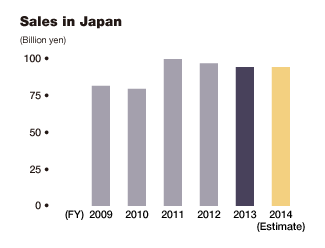

Positioning of the Japanese Market

Daifuku’s R&D is mainly centered in Japan, the location of Daifuku’s headquarters and a key location for its global business operations. Over the nearly 80 years since its establishment, the reason Daifuku remains a growing company and a source of pride is its unrelenting drive to accommodate the needs of diversified industries and business models with products that fit with the times. Daifuku is imparting the material handling expertise developed in Japan to its subsidiaries outside Japan, and, after identifying the needs of local markets, is working jointly with the subsidiaries to create products that meet these needs.

In addition, factories in Japan provide core components of Daifuku products around the world. With a sales volume that ranks in the top two in the world, Japan is also significantly contributing to the performance of the Group through its major cost-cutting efforts by reviewing and making improvements in its procurement activities and expanding in-house production.

Growth Strategies

The Japanese market is expected to show continued stability, with ongoing trends including industrial realignments in customer industries; reforms in distribution and logistics, including the further development of e-commerce; and a rising need for automation due to a lack in workforce from low birthrates and demographic aging of the population. Aftermarket services for the large number of past installations are a primary source of earnings for Daifuku, and demand for the retrofit and replacement of existing equipment is increasing.

In addition, Daifuku is taking initiatives to develop new value-added and highly profitable products that will incorporate innovative, new technologies. Meanwhile, since demand for e-commerce related systems is increasing, Daifuku will press forward with the development of new products suited to this sector.

Using RFID technology, a cosmetics company increased throughput and shipping accuracy for online mail orders.

Using RFID technology, a cosmetics company increased throughput and shipping accuracy for online mail orders.